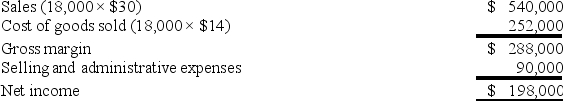

Tim's Tools,a manufacturer of cordless drills,began operations this year.During this year,the company produced 20,000 units and sold 18,000 units.At year-end,the company reported the following income statement using absorption costing:  Production costs per unit total $14,which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) .60% of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per unit total $14,which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) .60% of total selling and administrative expenses are variable.Compute net income under variable costing.

A) $307,800

B) $198,000

C) $195,800

D) $288,000

E) $220,000

Correct Answer:

Verified

Q121: Jeter Corporation had net income of $212,000

Q122: What is Red and White's net income

Q123: Given the following data,calculate product cost per

Q124: Front Company had net income of $72,500

Q125: Pact Company had net income of $972,000

Q127: Fields Cutlery,a manufacturer of gourmet knife sets,produced

Q128: Given the following data,calculate the total product

Q129: Given the following data,calculate product cost per

Q130: Wind Fall,a manufacturer of leaf blowers,began operations

Q131: What is Red and White's net income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents