Aces,Inc.,a manufacturer of tennis rackets,began operations this year.The company produced 6,000 rackets and sold 4,900.At year-end,the company reported the following income statement using absorption costing.  Production costs per tennis racket total $38,which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) .Ten percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per tennis racket total $38,which consists of $25 in variable production costs and $13 in fixed production costs (based on the 6,000 units produced) .Ten percent of total selling and administrative expenses are variable.Compute net income under variable costing.

A) $194,100

B) $165,500

C) $311,000

D) $240,500

E) $233,000

Correct Answer:

Verified

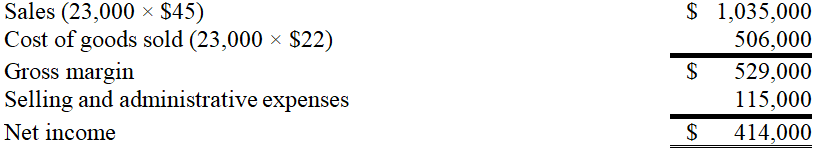

Q131: What is Red and White's net income

Q132: What is Red and White's contribution margin

Q133: Swola Company reports the following annual cost

Q134: Given the following data,calculate the total product

Q135: Swola Company reports the following annual cost

Q137: Decko Industries reported the following monthly data:

Q138: Swisher,Incorporated reports the following annual cost data

Q139: Kluber,Inc.had net income of $900,000 based on

Q140: A company is currently operating at 70%

Q141: How will net income under variable costing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents