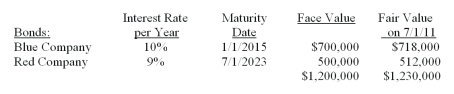

On July 1,2011,Kent County received the following securities to be held as the principal of a trust; the income from the securities is to be transferred to the Kent Heritage Museum,a private not-for-profit museum.  Required

Required

1)In what type of fiduciary fund should the receipt of the bonds described above be recorded?

2)Show in general journal form the entry that should be made to record the receipt of the bonds.

3)On January 1,2012,interest received in cash amounted to $57,500 ($35,000 on Blue Company bonds and $22,500 on Red Company bonds).Assuming that income from the bonds is to be computed on the accrual basis,what is the amount of income for the period 7/1/11 - 12/31/11 that should be transferred to the Kent County Museum early in 2012? Show computations.

Correct Answer:

Verified

1.Private-purpose tr...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Which of the following is the appropriate

Q47: In financial reporting for proprietary funds and

Q50: If a city has a fiduciary responsibility

Q51: Which of the following activities would be

Q52: The following are key terms in Chapter

Q52: Explain the purpose of an investment trust

Q54: Explain the purpose of the account "undistributed

Q56: Ingham County collects,in addition to its own

Q59: Which of the following statements is true

Q61: Describe the types of pension plans most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents