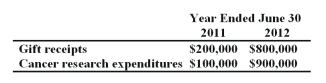

During the years ended June 30,2011 and 2012,Jackson University,a private university,conducted a cancer research project financed by a $1,000,000 gift from an alumnus.The entire amount was pledged by the donor on July 10,2010,although she paid only $200,000 at that date.The gift was restricted to the financing of this particular research project.During the two-year research period,Jasper's related gift receipts and research expenditures were as follows:  How much contribution revenue should Jasper University report for the year ended June 30,2012?

How much contribution revenue should Jasper University report for the year ended June 30,2012?

A) $0

B) $800,000

C) $900,000

D) $1,000,000

Correct Answer:

Verified

Q21: Economic rationality would argue against a university

Q22: Tuition scholarships for which there is no

Q30: Which of the following is a typical

Q31: Are public and private colleges and universities

Q32: FASB standards applicable to private colleges and

Q33: Which of the following statements usually will

Q35: Which of the following is required as

Q37: Which of the following is not a

Q38: Which of the following relationships indicates that

Q39: "Tuition and fees should be recorded as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents