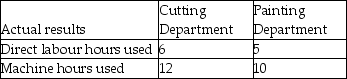

The Highland Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments-cutting and painting.The Cutting Department uses a departmental overhead rate of $15 per machine hour,while the Painting Department uses a departmental overhead rate of $9 per direct labour hour.Job 586 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 586 is $900.

Required: What was the total cost of Job 586 if the Highland Corporation used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Direct labour hours would be the most

Q13: With increased competition, managers need more accurate

Q16: To determine the amount of overhead allocated,

Q17: As a result of cost distortion, either

Q22: Bond Industries uses departmental overhead rates to

Q24: Credit Valley Products manufactures its products in

Q25: Green Bags Company manufactures cloth grocery bags

Q28: When calculating a departmental overhead rate, the

Q36: The allocation base selected for each department

Q49: Sector's Machine Works manufactures custom equipment. Sector's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents