Use the following information to answer the question(s) below..

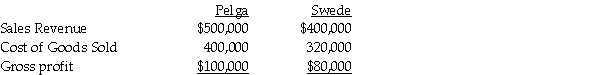

Pelga Company routinely receives goods from its 80%-owned subsidiary,Swede Corporation.In 2014,Swede sold merchandise that cost $80,000 to Pelga for $100,000.Half of this merchandise remained in Pelga's December 31,2014 inventory.This inventory was sold in 2015.During 2015,Swede sold merchandise that cost $160,000 to Pelga for $200,000.$62,500 of the 2015 merchandise inventory remained in Pelga's December 31,2015 inventory.Selected income statement information for the two affiliates for the year 2015 was as follows:

-Shalles Corporation,a 80%-owned subsidiary of Pani Corporation,sold inventory items to its parent at a $48,000 profit in 2014.Pani resold one-third of this inventory to outside entities.Shalles reported net income of $200,000 for 2014.Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is

A) $30,400.

B) $32,000.

C) $33,600.

D) $40,000.

Correct Answer:

Verified

Q2: A(n)_ sale is a sale by a

Q6: Use the following information to answer the

Q8: Use the following information to answer the

Q9: Phast Corporation owns a 80% interest in

Q12: A parent company regularly sells merchandise to

Q13: Use the following information to answer the

Q14: Use the following information to answer the

Q16: Use the following information to answer the

Q18: Use the following information to answer the

Q19: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents