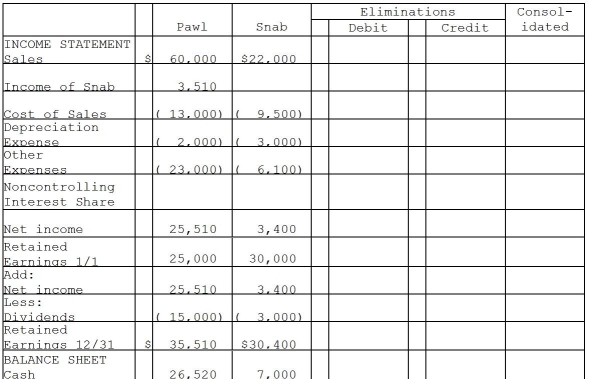

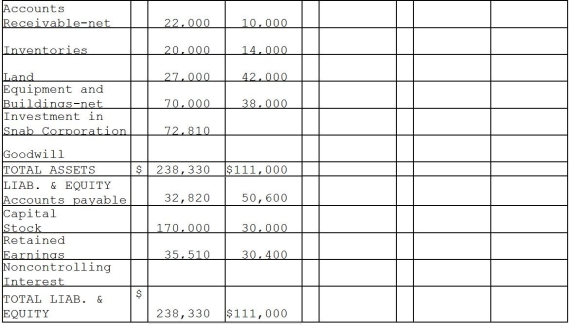

Pawl Corporation acquired 90% of Snab Corporation on January 1,2014 for $72,000 cash when Snab's stockholders' equity consisted of $30,000 of Capital Stock and $30,000 of Retained Earnings.The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000.The remainder was attributable to goodwill.The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2014.

Correct Answer:

Verified

Q5: Use the following information to answer question(s)

Q12: Use the following information to answer question(s)

Q17: When preparing the consolidation workpaper for a

Q19: A parent company uses the equity method

Q21: Packo Company acquired all the voting stock

Q23: Powell Corporation acquired 90% of the voting

Q24: Parakeet Company has the following information collected

Q25: Platt Corporation paid $87,500 for a 70%

Q26: Parrot Corporation acquired 90% of Swallow Co.on

Q38: On January 2,2014,PBL Enterprises purchased 90% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents