Use the following information to answer the question(s)below.

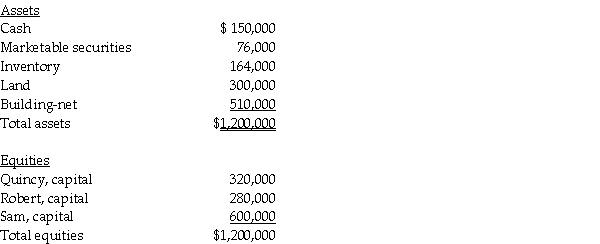

Quincy has decided to retire from the partnership of Quincy,Robert,and Sam.The partnership will pay Quincy $400,000.Total partnership capital should be revalued based on the excess payment to Quincy.(Assume the book values of the assets listed below equals fair values . )A summary balance sheet for the Quincy,Robert,and Sam partnership appears below.Quincy,Robert,and Sam share profits and losses in a ratio of 1:1:3,respectively.

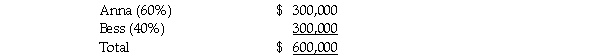

-Anna and Bess share partnership profits and losses at 60% and 40%,respectively.The partners agree to admit Cal into the partnership for a 50% interest in capital and earnings.Capital accounts immediately before the admission of Cal are:

Required:

1.Prepare the journal entry(s)for the admission of Cal to the partnership assuming Cal invested $400,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Cal paid the money directly to Anna and to Bess for 50% of each of their respective capital interests.The partnership records goodwill.

2.Prepare the journal entry(s)for the admission of Cal to the partnership assuming Cal invested $500,000 for the ownership interest.Cal paid the money to the partnership for a 50% interest in capital and earnings.Assume the valuation is based on the capital of the current partnership,which is fairly valued.The partnership records goodwill.

3.Prepare the journal entry(s)for the admission of Cal to the partnership assuming Cal invested $700,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Cal paid the money to the partnership for a 50% interest in capital and earnings.The partnership records goodwill.

Correct Answer:

Verified

If a $400,000 payment re...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: A partner assigned his partnership interest to

Q17: Use the following information to answer the

Q18: Use the following information to answer the

Q21: A summary balance sheet for the partnership

Q25: A summary balance sheet for the Ash,Brown,and

Q26: Daniel,Ethan,and Frank have a retail partnership business

Q32: Required:

1.Prepare a schedule to allocate income or

Q33: The profit and loss sharing agreement for

Q34: On February 1,2014,George,Hamm,and Ishmael began a partnership

Q38: Required:

1.Prepare a schedule to allocate income or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents