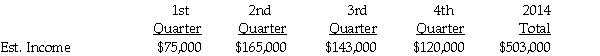

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Correct Answer:

Verified

Q21: The following information was collected together for

Q22: Tillman Fabrications has five operating segments,as summarized

Q23: The following data relate to Falcon Corporation's

Q24: For internal decision-making purposes,Calam Corporation's operating segments

Q25: Rollins Publishing has five operating segments,as summarized

Q27: For internal decision-making purposes,Dashwood Corporation's operating segments

Q28: Quantex Corporation has five operating segments,as summarized

Q29: The accountant for Baxter Corporation has assigned

Q30: For internal decision-making purposes,Geogh Corporation identifies its

Q31: Jeale Corporation is preparing its interim financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents