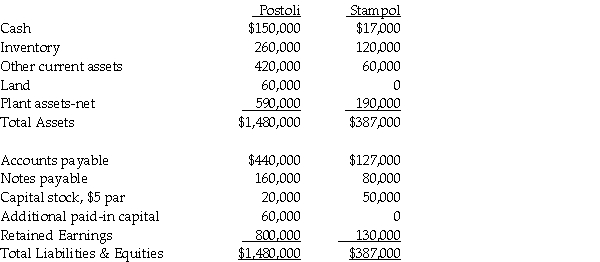

On June 30,2013,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2013 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Correct Answer:

Verified

*Cash payment...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Use the following information to answer

Q9: Historically,much of the controversy concerning accounting requirements

Q17: In reference to the FASB disclosure requirements

Q18: According to FASB Statement 141R,which one of

Q21: On December 31,2013,Peris Company acquired Shanta Company's

Q23: On January 2,2013,Pilates Inc.paid $900,000 for all

Q24: Pali Corporation exchanges 200,000 shares of newly

Q25: Saveed Corporation purchased the net assets of

Q26: Bigga Corporation purchased the net assets of

Q27: On January 2,2013,Pilates Inc.paid $700,000 for all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents