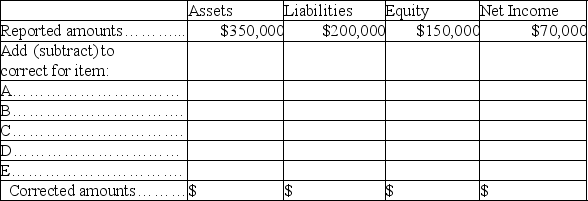

A company issued financial statements for the year ended December 31,but failed to include the following adjusting entries:

A.Accrued interest revenue earned of $1,200.

B.Depreciation expense of $4,000.

C.Portion of prepaid insurance expired (an asset)used $1,100.

D.Accrued taxes of $3,200.

E.Revenues of $5,200,originally recorded as unearned,have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the following table:

Correct Answer:

Verified

Q142: How is the current ratio calculated? How

Q151: Describe a work sheet and explain why

Q159: How is a classified balance sheet different

Q203: On December 14, Branch Company received $3,000

Q207: A company's employees earn a total of

Q215: Prior to recording adjusting entries on December

Q229: Carroll Co. is a multi-million dollar business.

Q394: Given the table below,indicate the impact of

Q398: Using the table below,indicate the impact of

Q401: Based on the unadjusted trial balance for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents