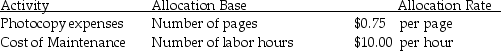

Vincent Jardine,a CPA,has a firm in the state of New York.Vincent uses ABC to allocate overhead costs and has computed the following predetermined overhead allocation rates:

Vincent has important contacts in the northeastern parts of New York.During the past month,Vincent completed a job for Nurix Inc.The job required 135 labor hours and 4,000 photocopies.Determine the amount of indirect costs to be allocated to the job.

Vincent has important contacts in the northeastern parts of New York.During the past month,Vincent completed a job for Nurix Inc.The job required 135 labor hours and 4,000 photocopies.Determine the amount of indirect costs to be allocated to the job.

Correct Answer:

Verified

Q61: Dunby Inc.is a consulting firm that offers

Q62: Dunby Inc.,a law consulting firm,has been using

Q64: While using an activity-based costing in service

Q65: An inventory management system in which a

Q67: Dunby Inc.is a consulting firm that offers

Q68: The steps of an activity-based costing for

Q69: Dunby Inc.,a law consulting firm,has been using

Q70: Jetz Inc.manufactures water bottles for children.Similar water

Q71: J-Time Inc.is planning to launch a new

Q113: Activity-based costing can be used in determining

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents