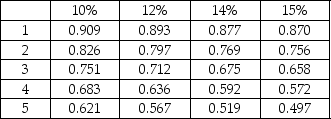

Gamma Corp.is considering an investment opportunity with the following expected net cash inflows: Year 1,$250,000; Year 2,$350,000; Year 3,$395,000.The company uses a discount rate of 12%,and the initial investment is $750,000. The following table is available:

Present Value of $1: The IRR of the project will be ________.

The IRR of the project will be ________.

A) less than 12%

B) between 12% and 13%

C) between 14% and 15%

D) more than 12%

Correct Answer:

Verified

Q86: When calculating the net present value of

Q101: When comparing several investments with the same

Q102: A company is considering an iron ore

Q103: The following details are provided by Volvox

Q105: Which of the following best describes the

Q106: Nobell Machines Company is evaluating an investment

Q108: The following details are provided by Doppler

Q109: Under conditions of limited resources,when a company

Q119: Which of the following would be the

Q126: When the internal rate of return is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents