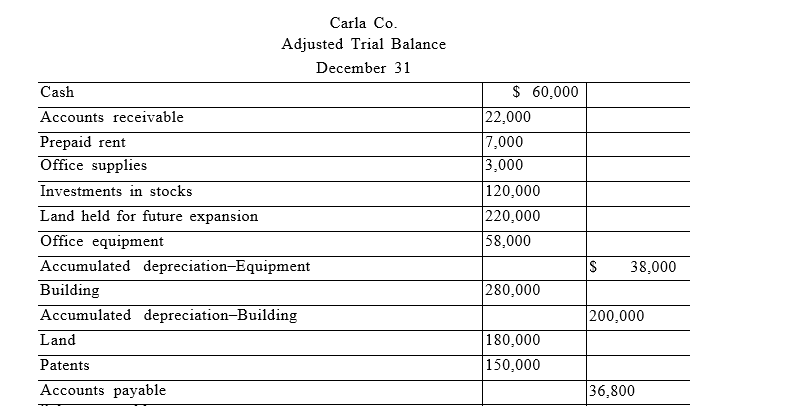

The Following Adjusted Trial Balance Is for Carla Co Required: Prepare a Classified Balance Sheet as of December 31

The following adjusted trial balance is for Carla Co. at year-end December 31. The credit balance in Carla West, Capital at the beginning of the year, January 1, was $320,000. The owner, Carla West, invested an additional $100,000 during the current year. The land held for future expansion was also purchased during the current year.

Required: Prepare a classified balance sheet as of December 31. (Note: A $21,000 installment on the long-term note payable is due within one year.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q157: For the year ended December 31, a

Q158: Which of the following accounts could not

Q159: How is a classified balance sheet different

Q160: Reversing entries are linked to _ and

Q161: The adjusted trial balance of the

Q163: The following information has been gathered for

Q164: Calculate the current ratio for each

Q165: The closing process resets _, _, and

Q166: Paradise Travel's adjusted trial balance as of

Q167: The _ account is a temporary account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents