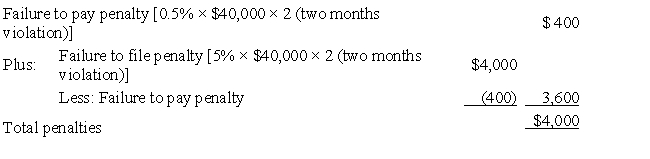

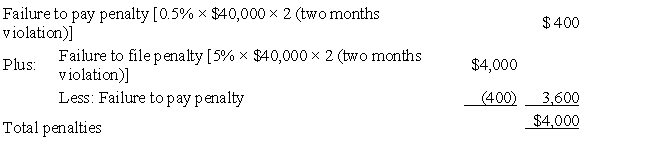

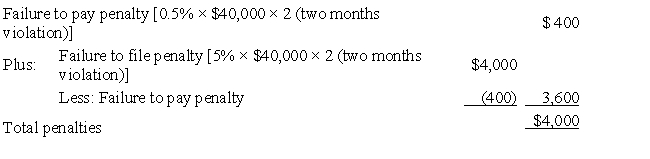

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000 which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

A) $400.

B) $3,600.

C) $4,000.

D) $4,400.

E) None of these.

Correct Answer:

Verified

Q104: Regarding proper ethical guidelines, which (if any)

Q105: On his 2017 income tax return, Andrew

Q107: Allowing a domestic production activities deduction for

Q107: A landlord leases property upon which the

Q108: A VAT (value added tax):

A) Is regressive

Q110: Several years ago, Logan purchased extra grazing

Q111: In terms of probability, which of the

Q113: Social considerations can be used to justify:

A)Allowance

Q113: Which, if any, of the following provisions

Q117: Which of the following is a characteristic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents