On January 5,2014,Eagle Corporation paid $50,000 in real estate taxes for the calendar year.In March of 2014,Eagle paid $180,000 for an annual machinery overhaul and $10,000 for the annual CPA audit fee.What amount was expensed for these items on Eagle's quarterly interim financial statements?

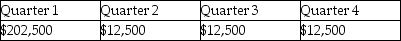

A)

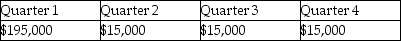

B)

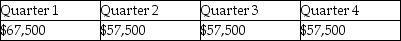

C)

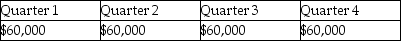

D)

Correct Answer:

Verified

Q14: Which one of the following operating segment

Q15: What is the threshold for reporting a

Q16: GAAP requires that segment information be reported

A)by

Q17: An enterprise has eight reporting segments.Five segments

Q18: Cole Company has the following 2014 financial

Q20: For an operating segment to be considered

Q21: For internal decision-making purposes,Falcon Corporation identifies its

Q22: The following information was collected together for

Q23: For internal decision-making purposes,Elom Corporation's operating segments

Q24: Rollins Publishing has five operating segments,as summarized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents