Use the following information to answer the question(s) below.

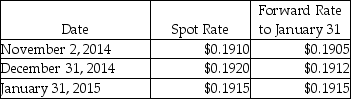

On November 2, 2014, Bellamy Corporation sells product to their Danish customer. At the same time, Bellamy signed a forward contract to sell 200,000 Danish krone in ninety days to hedge the account receivable at $0.1905, the 90-day forward rate. The receivable is expected to be collected in ninety days. Assume the forward contract will be settled net and this is a fair value hedge. The related exchange rates are shown below:

-Assuming a present value factor of 1 for simplicity,what is the fair value of this forward contract on November 2?

A) $-0-

B) $100 asset

C) $100 liability

D) $38,100 asset

Correct Answer:

Verified

Q4: When preparing their year-end financial statements,the Warner

Q5: A fair value hedge differs from a

Q6: The purchase price of an option contract

Q7: A highly-effective hedge of an existing asset

Q8: Barnes Company entered into a forward contract

Q10: If a financial instrument is classified as

Q11: International accounting standards differ from U.S.Generally Accepted

Q12: Use the following information to answer the

Q13: Use the following information to answer the

Q14: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents