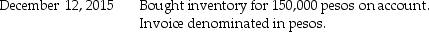

Johnson Corporation (a U.S.company)began operations on December 1,2015,when the owner contributed $100,000 of his own money to establish the business.Johnson then had the following import and export transactions with unaffiliated Mexican companies:

Janury 15,2016 Collected the 120,001 pesos from the Mexican customer and immediately converted them into U. S dollars. The following exchange rates apply:

Janury 15,2016 Collected the 120,001 pesos from the Mexican customer and immediately converted them into U. S dollars. The following exchange rates apply:

Required:

1.What were Sales in the income statement for the year ended December 31,2015?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2015?

4.What is the Inventory balance in the balance sheet at December 31,2015?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Jefferson Company entered into a forward contract

Q27: Crabby Industries,a U.S.corporation,purchased inventory from a company

Q28: The table below provides either a direct

Q29: Blue Corporation,a U.S.manufacturer,sold goods to their customer

Q30: In September of 2014,Gunny Corporation anticipates

Q32: On September 1,2014,Bylin Company purchased merchandise from

Q33: Piel Corporation (a U.S.company)began operations on January

Q34: On November 1,2014,the Yankee Corporation,a U.S.corporation,purchased and

Q35: On October 15,2014,Napole Corporation,a French company,ordered merchandise

Q36: Tank Corporation,a U.S.manufacturer,has a June 30 fiscal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents