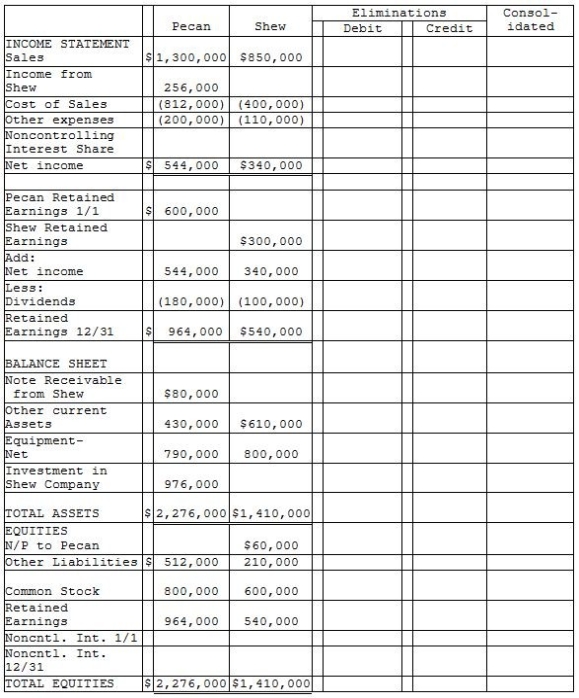

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2014,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2015,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

Correct Answer:

Verified

Q23: Pennack Corporation purchased 75% of the outstanding

Q24: Parakeet Company has the following information collected

Q25: Under the equity method of accounting parent-retained

Q26: Parrot Corporation acquired 90% of Swallow Co.on

Q27: Pawl Corporation acquired 90% of Snab Corporation

Q29: Packo Company acquired all the voting stock

Q30: On December 31,2014,Patenne Incorporated purchased 60% of

Q31: Pommu Corporation paid $78,000 for a 60%

Q32: Adjustments made for consolidation statements impact both

Q33: Puddle Corporation acquired all the voting stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents