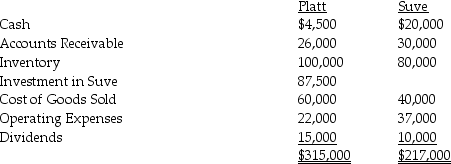

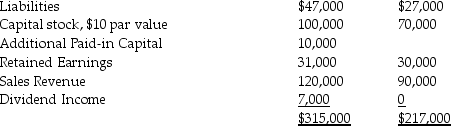

Platt Corporation paid $87,500 for a 70% interest in Suve Corporation on January 1,2014,when Suve's Capital Stock was $70,000 and its Retained Earnings $30,000.The fair values of Suve's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2014 are given below:

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31,2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Adjustments made for consolidation statements impact both

Q33: Puddle Corporation acquired all the voting stock

Q34: Pull Incorporated and Shove Company reported summarized

Q35: On January 2,2014,Paleon Packaging purchased 90% of

Q36: On January 1,2014,Paisley Incorporated paid $300,000 for

Q38: On January 2,2014,PBL Enterprises purchased 90% of

Q39: Powell Corporation acquired 90% of the voting

Q40: Flagship Company has the following information collected

Q41: Proceeds from the sale of land are

Q42: The GAAP only authorizes the use of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents