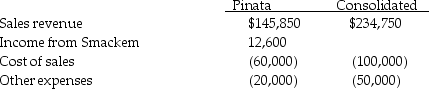

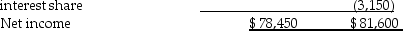

Pinata Corporation acquired an 80% interest in Smackem Inc.for $130,000 on January 1,2014,when Smackem had Capital Stock of $125,000 and Retained Earnings of $25,000.Assume the fair value and book value of Smackem's net assets were equal on January 1,2014.Pinata's separate income statement and a consolidated income statement for Pinata and Subsidiary as of December 31,2014,are shown below.  Noncontrolling

Noncontrolling Smackem's separate income statement must have reported net income of

Smackem's separate income statement must have reported net income of

A) $13,750.

B) $14,750.

C) $15,750.

D) $15,250.

Correct Answer:

Verified

Q15: Pardo Corporation paid $140,000 for a 70%

Q16: On July 1,2014,when Salaby Company's total stockholders'

Q17: Perth Corporation acquired a 100% interest in

Q18: Percy Inc.acquired 80% of the outstanding stock

Q19: Push-down accounting

A)requires a subsidiary to use the

Q21: On January 1,2014,Myna Corporation issued 10,000 shares

Q22: Petra Corporation paid $500,000 for 80% of

Q23: Polaris Incorporated purchased 80% of The Solar

Q24: Pamula Corporation paid $279,000 for 90% of

Q25: On July 1,2014,Polliwog Incorporated paid cash for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents