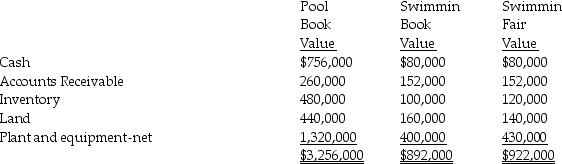

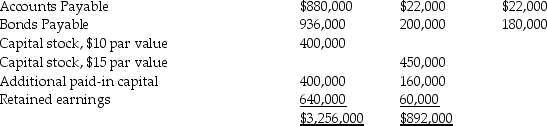

Pool Industries paid $540,000 to purchase 75% of the outstanding stock of Swimmin Corporation,on December 31,2014.Any excess fair value over the identified assets and liabilities is attributed to goodwill.The following year-end information was available just before the purchase:

Using the data provided above,assume that Pool decided rather than paying $540,000 cash,Pool issued 10,000 shares of their own stock to the owners of Swimmin.At the time of issue,the $10 par value stock had a market value of $60 per share.

Using the data provided above,assume that Pool decided rather than paying $540,000 cash,Pool issued 10,000 shares of their own stock to the owners of Swimmin.At the time of issue,the $10 par value stock had a market value of $60 per share.

Required: Prepare Pool's consolidated balance sheet on December 31,2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Petra Corporation paid $500,000 for 80% of

Q23: Polaris Incorporated purchased 80% of The Solar

Q24: Pamula Corporation paid $279,000 for 90% of

Q25: On July 1,2014,Polliwog Incorporated paid cash for

Q26: Pal Corporation paid $5,000 for a 60%

Q28: On January 2,2014,Power Incorporated paid $630,000 for

Q29: Passcode Incorporated acquired 90% of Safe Systems

Q30: A corporation becomes a subsidiary when another

Q31: On January 1,2014,Parry Incorporated paid $72,000 cash

Q32: Pool Industries paid $540,000 to purchase 75%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents