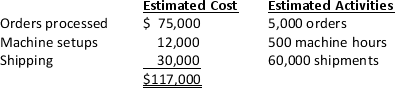

Jones Manufacturing Company makes two products.The company's budget includes $500,000 of overhead.In the past,the company allocated overhead based on estimated total direct labor hours of 20,000.Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders,machine setups,and good shipped.The following is a summary of company information:

Required:

a. Calculate the company’s overhead rate based on total direct hours.

b. Calculate the company’s overhead rates using the activity-based costing pools.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q163: Assume you have been hired by a

Q164: The process of using activity-based costing information

Q166: You have been hired by a company

Q168: What is an activity cost pool and

Q170: Megan Industries manufactures several products including a

Q171: The following list includes activities that are

Q174: Camilla,Inc.uses activity-based costing to cost its two

Q176: Angora,Inc.uses activity-based costing to cost its two

Q177: Clover Manufacturing Company makes two products. The

Q178: Paula's Payroll Services provides weekly payroll processing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents