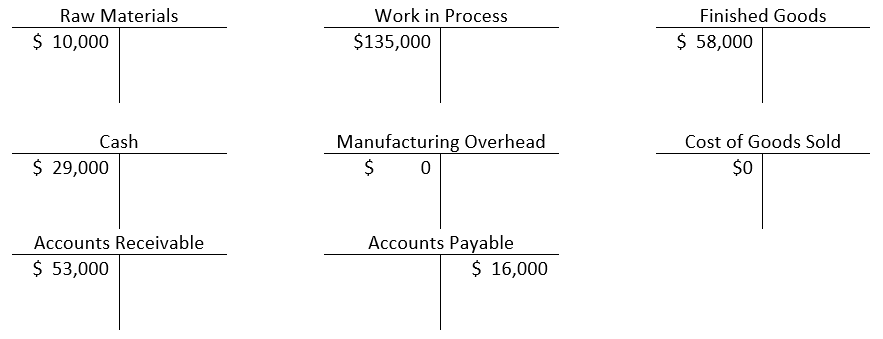

Adams Corporation manufactures stained glass windows. Since each job is unique in color and design, Adams uses a job-order costing system. Adams has provided you with the following January 1, 2014 account balances.  During 2014, the following transactions occurred:

During 2014, the following transactions occurred:

1. Adams purchased raw materials for $160,000 on account

2. Adams used $150,000 of raw materials in production. Eighty percent were direct materials and 20 percent were indirect materials.

3. $69,000 of direct labor and $27,000 of indirect labor was incurred and paid.

4. Other manufacturing overhead incurred on account totaled $52,000.

5. Adams completed production on goods costing $280,000.

6. Adams sales revenue was $510,000. All goods were sold on account.

7. Adams’ cost of goods sold was $320,000 before adjusting for over-/under-applied overhead.

8. Adams applies overhead at 200% of direct labor cost.

9. Adams collected $530,000 from customers and paid $140,000 to vendors.

10. Adams closes over-/under-applied overhead to Cost of Goods Sold.

Required:

a. Record the transactions above in the appropriate T-accounts and calculate the ending balances.

b. Calculate total manufacturing costs.

Correct Answer:

Verified

b. $120...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q153: River Rafters produces angler kayaks.The company uses

Q159: Office Equipment, Inc. manufactures custom filing

Q161: Leisure World produces folding padded hammocks.The hammocks

Q168: Describe the three major categories of product

Q169: What is the cost of goods manufactured?

Q173: Predetermined overhead rates and manufacturing overhead application

Q174: Students who have not taken an accounting

Q176: Ignatenko Company estimates it will incur $2,400,000

Q180: What items decrease the following accounts: Raw

Q181: What items increase the following accounts: Raw

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents