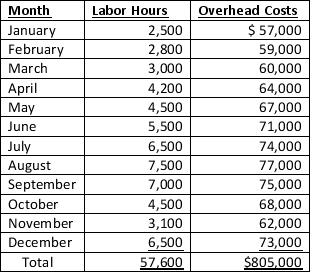

Bailey Jones owns a catering company that stages banquets and parties for both individuals and companies.The business is seasonal,with heavy demand during the summer months and year-end holidays and light demand at other times.Bailey has gathered the following cost information from the past year:

a.Using the high-low method,compute the overhead cost per labor hour and the fixed overhead cost per month.

b.Bailey has booked 2,800 labor hours for the coming month.How much overhead should he expect to incur?

c.If Bailey books one more catering job for the month,requiring 200 labor hours,how much additional overhead should he expect to incur?

d.Bailey recently attended a meeting of the local Chamber of Commerce,at which he heard an accounting professor discuss regression analysis and its business applications.After the meeting,Bailey enlisted the professor's assistance in preparing a regression analysis of the overhead data he collected.This analysis yielded an estimated fixed cost of $48,000 per month and a variable cost of $4 per labor hour.Why do these estimates differ from your high-low estimates,calculated in part a?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: Assume a selling price of $20 per

Q143: Assume a selling price of $20 per

Q146: Gabbard and Fink CPA firm leases tax

Q147: Nancy's Nursery provides and maintains live plants

Q149: MousePad Computer Company,in addition to its retail

Q150: Data concerning Engel Company's activity for the

Q152: FastPrint Company leases a machine that stuffs,seals,and

Q153: Indicate which of the following costs are

Q154: Complete the following table,identifying the following as

Q156: Restate the following income statement in contribution

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents