Big Valley Ltd. purchased machinery on January 2, 2012, at a total cost of $85,000. The machinery's estimated useful life is 8 years or 60,000 hours, and its residual value is $5,000. During 2012 and 2013, the machinery was used 7,000 and 7,500 hours, respectively.

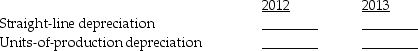

Compute depreciation under straight-line, units-of-production, and double-declining-balance methods for 2012 and 2013.

Double-declining-balance

Double-declining-balance

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: For each of the independent situations below,determine

Q62: The Mash Tun Corp. purchased equipment on

Q63: Explain how a company should decide which

Q65: A fully amortized asset is an asset:

A)

Q66: Victory Stables purchased new equipment for their

Q68: Lauter Tun Corporation acquired equipment on January

Q68: Big Rock Times Corporation (BRT) acquired equipment

Q69: Victory Stables purchased new equipment for their

Q70: Rainier Corporation purchased five automobiles at the

Q89: The Accumulated Depreciation account represents a source

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents