Answer the following questions using the information below:

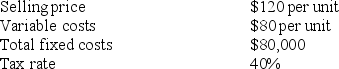

Assume the following cost information for Fernandez Company:

-If Bel Air Realtor plans an operating income of $210,000 and the tax rate is 30%, then Bel Air's planned net income should be:

A) $63,000

B) $147,000

C) $273,000

D) $357,000

Correct Answer:

Verified

Q47: Assume only the specified parameters change in

Q109: An increase in the tax rate will

Q110: Bassman Company operates on a contribution margin

Q111: Answer the following questions using the information

Q111: If planned net income is $30,000 and

Q112: The Holiday Card Company, a producer of

Q113: The breakeven point decreases if:

A)the variable cost

Q114: What effect, and why, would an increase

Q118: If operating income is $40,000 and the

Q120: Assume there is an increase in advertising

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents