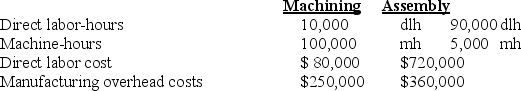

Hill Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products. Manufacturing overhead costs are applied on the basis of machine-hours in the Machining Department and on the basis of direct labor-hours in the Assembly Department. At the beginning of 20X5, the following estimates were provided for the coming year:

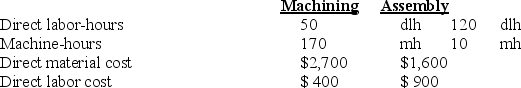

The accounting records of the company show the following data for Job #846:

The accounting records of the company show the following data for Job #846:

Required:

Required:

a. Compute the manufacturing overhead allocation rate for each department.

b. Compute the total cost of Job #846.

c. Provide possible reasons why Hill Manufacturing uses two different cost allocation rates.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: The ending balance in the Work-in-Process Control

Q107: For normal costing, even though the budgeted

Q107: A budgeted indirect-cost rate is computed for

Q109: What is the appropriate journal entry if

Q111: All of the following are true of

Q113: Actual (rather than allocated)manufacturing overhead costs are

Q114: In a normal costing system, the Manufacturing

Q114: All of the following items are debited

Q115: What is the appropriate journal entry if

Q116: All of the following are general ledger

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents