Answer the following questions using the information below:

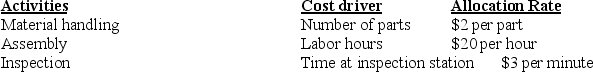

Nichols, Inc., manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

-What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 100 remote controls are produced? The batch requires 500 parts, 10 direct manufacturing labor hours, and 5 minutes of inspection time.

A) $12.15 per remote control

B) $1215 per remote control

C) $24.30 per remote control

D) $48.60 per remote control

Correct Answer:

Verified

Q81: Answer the following questions using the

Q84: A manufacturing firm produces multiple families of

Q87: Answer the following questions using the

Q97: Answer the following questions using the information

Q101: Answer the following questions using the information

Q103: Answer the following questions using the information

Q104: When designing a costing system, it is

Q106: ABC systems seek a cost allocation base

Q107: Answer the following questions using the

Q107: Availability of reliable data and measures should

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents