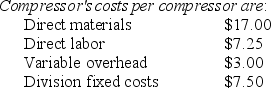

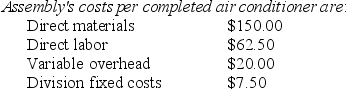

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division. The Compressor Division's operating income is:

A) $15,875

B) $16,375

C) $17,375

D) $18,250

Correct Answer:

Verified

Q23: _ means minimum constraints and maximum freedom

Q37: An important advantage of decentralized operations is

Q38: A benefit of decentralization is that it

Q39: Which of the following statements is FALSE?

A)A

Q42: Answer the following questions using the information

Q44: Answer the following questions using the information

Q45: Answer the following questions using the information

Q46: The costs used in cost-based transfer prices

Q46: Answer the following questions using the information

Q49: A product may be passed from one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents