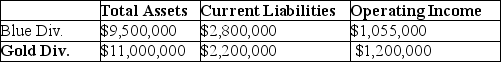

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  What is Economic Value Added (EVA®) for the Blue Division?

What is Economic Value Added (EVA®) for the Blue Division?

A) -$233,400

B) $21,960

C) $188,600

D) $433,960

Correct Answer:

Verified

Q44: Answer the following questions using the

Q50: The after-tax average cost of all the

Q53: Answer the following questions using the

Q53: Which of the following is the correct

Q54: Answer the following questions using the

Q55: Using residual income as a measure of

Q55: Springfield Corporation, whose tax rate is 40%,

Q56: Answer the following questions using the information

Q57: Answer the following questions using the information

Q59: A company which favors the residual income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents