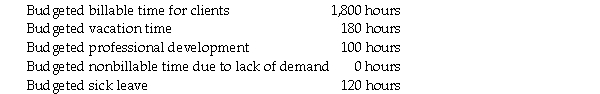

Beacon Company does residential real estate appraisals. There are 40 professionals on its staff. Each professional is allotted the following number of hours per year:

The company receives more jobs than it can handle and therefore rejects most out of town work. The budgeted salary for each professional is $44,000 per year with fringe benefits of $11,000.

The company receives more jobs than it can handle and therefore rejects most out of town work. The budgeted salary for each professional is $44,000 per year with fringe benefits of $11,000.

During the previous year, the actual salaries were $46,500, plus fringe benefits of $11,500.

Required:

a. What was the total budgeted direct cost rate if the company believes that clients should be charged directly for its employees' salaries and benefits?

b. What was the budgeted direct cost rate if the company wants to charge clients for employee vacation, sick leave, and professional development as an indirect cost?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Landscape Architects provides landscape consulting services to

Q102: Proration is the equalization of the overhead

Q106: The Manufacturing Overhead Control account is debited

Q107: The actual costs of all individual overhead

Q108: Underallocated indirect costs cannot occur when normal

Q109: To allocate or spread the under/overallocated overhead

Q115: A wholesale automobile company that buys and

Q121: The manufacturing overhead control account and the

Q123: When using the proration approach the final

Q139: The balance in the manufacturing overhead allocated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents