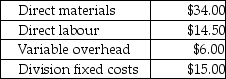

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

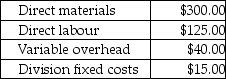

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

A) $81.75

B) $77.00

C) $9.00

D) $72.75

E) $51.00

Correct Answer:

Verified

Q94: The Mill Flow Company has two divisions.The

Q95: Sportswear Ltd.manufactures socks.The Athletic Division sells its

Q96: Answer the following question(s)using the information below.Cool

Q97: Answer the following question(s)using the information below.Cool

Q98: Alsation Ltd.has two divisions:.The Machining Division prepares

Q100: Centralia Components Ltd.manufactures cable assemblies used in

Q101: A market is said to be perfectly-competitive

Q102: For each of the following transfer price

Q103: For each of the following transfer price

Q104: Market-based transfer prices are ideal in perfectly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents