Answer the following question(s) using the information below.

Cool Air Ltd. manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $77. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.

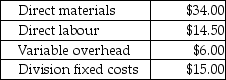

Compressor's costs per compressor are:

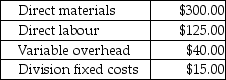

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-If the Assembly Division sells 1,000 air conditioners at a price of $750.00 per air conditioner to customers, what is the operating income of both divisions together?

A) $200,500

B) $207,000

C) $194,000

D) $165,750

E) $230,500

Correct Answer:

Verified

Q64: Explain what transfer prices are, and what

Q65: Bedtime Bedding Ltd. manufactures pillows. The Cover

Q67: Vancouver Valley Ltd. has two divisions, Computer

Q71: Answer the following question(s) using the information

Q73: Answer the following question(s) using the information

Q74: Alsation Ltd. has two divisions: Machining and

Q75: Sportswear Ltd. manufactures socks. The Athletic Division

Q96: Answer the following question(s)using the information below.Cool

Q99: Answer the following question(s)using the information below.Cool

Q114: Transfer prices among divisions within Canada are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents