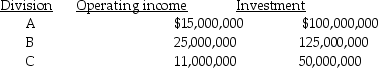

Capital Investments has three divisions. Each division's required rate of return is 15 percent. Planned operating results for 2011 are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: Batman Abstract Company has three divisions that

Q72: Randall Ltd. reported the following results for

Q73: Outline and discuss the steps involved in

Q74: The following table presents information related to

Q75: Stratton Industries has two divisions. These divisions

Q77: LaserLife Printer Cartridge Company is a decentralized

Q78: Last year Reynolds Ltd. reported the following

Q79: Hargrave Products has three divisions which operate

Q90: The economic value added concept has attracted

Q106: Use the information below to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents