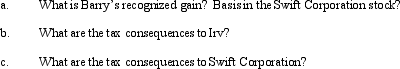

Barry and Irv form Swift Corporation. Barry transfers cash of $100,000 and equipment (basis of $300,000 and fair market value of $400,000) for 50% of Swift's stock. Irv transfers land and building (basis of $510,000 and fair market value of $450,000) and agrees to manage the business for one year for the other 50% of Swift's stock. The value of Irv's services for one year is $50,000.

Correct Answer:

Verified

Q84: In order to encourage the development of

Q85: In 2004, Donna transferred assets (basis of

Q89: Sean, a sole proprietor, is engaged in

Q89: Issues relating to basis arise when a

Q91: Lark City donates land worth $300,000 and

Q93: Five years ago, Joe, a single taxpayer,

Q101: How is the transfer of liabilities in

Q101: Stock in Merlin Corporation is held equally

Q104: When forming a corporation, a transferor-shareholder may

Q106: What is the rationale underlying the tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents