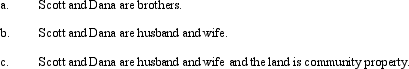

In 1985, Scott and Dana acquire land for $600,000 with Scott furnishing $200,000 and Dana $400,000 of the purchase price. Title to the property is listed as equal joint tenancy with right of survivorship. Scott dies first in 2011, when the land is worth $3,000,000. What is Dana's income tax basis in the property under each of the following assumptions?

Correct Answer:

Verified

Q93: Mel's estate includes a number of notes

Q97: Becky inherited property from her mother seven

Q98: In 2011, Arlene makes a gift of

Q99: In June 2010, Debra makes a gift

Q100: Which, if any, of the following procedures

Q102: Jane is the founder of Citron Corporation

Q104: At the time of her death in

Q105: Bob and Paige are married and live

Q109: After a prolonged illness,Claire has been diagnosed

Q116: Wesley has created an irrevocable trust: life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents