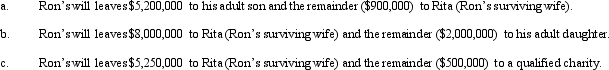

In each of the following independent situations, describe the effect of the disclaimer procedure on Ron's taxable estate. In this regard, advise as to how much should be disclaimed, by whom, and whether a disclaimer should be made. Assume the year involved is 2011.

Correct Answer:

Verified

Q103: Barney creates a trust,income payable to Chloe

Q107: Fred and Pearl always have lived in

Q109: Joseph makes a gift of securities (basis

Q110: Using investments worth $1 million, Roland establishes

Q111: Art makes a gift of stock in

Q113: Match each statement with the correct choice.

Q114: In February 2010, Taylor sold real estate

Q114: Carol inherits her father's farm,and the executor

Q117: In April 2010, Ed gives his mother,

Q118: For purposes of § 6166 (i.e. ,extension

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents