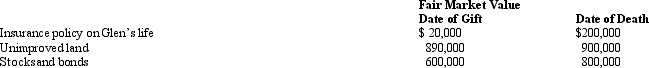

In 2009, Glen transferred several assets by gift to different persons. Glen dies in 2011. Information regarding the properties given is summarized below.  The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

A) $0.

B) $200,000.

C) $260,000.

D) $1,900,000.

E) $1,960,000.

Correct Answer:

Verified

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q135: In 1980, Mandy and Hal (mother and

Q136: At the time of her death in

Q136: Waldo is his mother's sole heir and

Q137: Ben and Lynn are married and have

Q138: At the time of his death on

Q141: As reflected by the tax law, Congressional

Q142: Burt and Eve are husband and wife

Q145: Calvin's will passes $800,000 of cash to

Q146: Walt dies intestate (i.e. ,without a will)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents