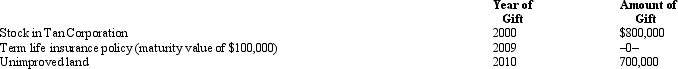

Prior to his death in 2011, Gordon made the following taxable gifts.

The policy of Gordon's life was given to the designated beneficiary. The gift of the stock and the land generated gift taxes of $28,750 and $64,250, respectively.

The policy of Gordon's life was given to the designated beneficiary. The gift of the stock and the land generated gift taxes of $28,750 and $64,250, respectively.

As to these transfers, how much is included in Gordon's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: Before his nephew (Dean) leaves for college,

Q118: Prior to his death in 2011, Alma

Q120: In which, if any, of the following

Q121: Among the assets included in Taylor's gross

Q122: Matt and Patricia are husband and wife

Q124: June made taxable gifts as follows: $400,000

Q125: Tom and Jean are husband and wife

Q126: Regarding the transfer tax credits available, which

Q127: In 1995, Thalia purchases land for $900,000

Q128: At the time of her death on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents