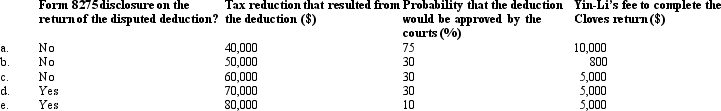

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: Carrie's AGI last year was $180,000. Her

Q126: Margaurite did not pay her Federal income

Q126: Leo underpaid his taxes by $250,000.Portions of

Q129: Loren Ltd., a calendar year taxpayer, had

Q131: The IRS periodically updates its list of

Q132: Compute the undervaluation penalty for each of

Q133: Compute the overvaluation penalty for each of

Q139: A(n) _ member is required to follow

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q153: The Treasury issues "private letter rulings" and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents