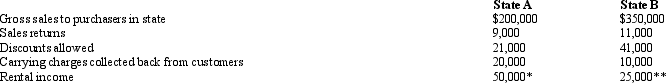

Shaker Corporation operates in two states, as indicated below. All goods are manufactured in State

A. Determine the sales to be assigned to both states to be used in computing Shaker's sales factor for the year. Both states follow the UDITPA and the MTC regulations in this regard.

* Excess warehouse space

* Excess warehouse space

** Land held for speculation

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: A state might levy a(n)_ tax when

Q130: Typically, a sales/use tax is applied to

Q131: Dott Corporation generated $300,000 of state taxable

Q133: Mercy Corporation, headquartered in F, sells wireless

Q134: Node Corporation is subject to tax only

Q137: Most jurisdictions levy a property tax on

Q138: The sale of a prescription medicine probably

Q139: Condor Corporation generated $450,000 of state taxable

Q140: Compute Quail Corporation's State Q taxable income

Q141: Your supervisor has shifted your responsibilities from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents