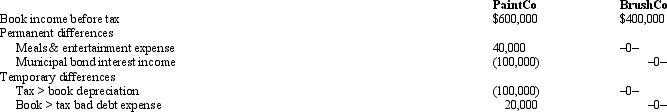

PaintCo Inc., a domestic corporation, owns 100% of BrushCo Ltd., an Irish corporation. Assume that the U.S. corporate tax rate is 35% and the Irish rate is 10%. PaintCo is permanently reinvesting BrushCo's earnings outside the United States under ASC 740-30 (APB 23). The corporations' book income, permanent and temporary book-tax differences, and current tax expense are as follows. Provide the income tax footnote rate reconciliation for PaintCo using both dollar amounts and percentages.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Gator, Inc., is a domestic corporation with

Q68: Amelia, Inc., is a domestic corporation with

Q69: Gator, Inc., is a domestic corporation with

Q70: Gator, Inc., is a domestic corporation with

Q72: At the beginning of the year,the balance

Q72: Amelia, Inc., is a domestic corporation with

Q73: Gator, Inc., is a domestic corporation with

Q74: Amelia, Inc., is a domestic corporation with

Q75: Amelia, Inc., is a domestic corporation with

Q76: Amelia, Inc., is a domestic corporation with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents