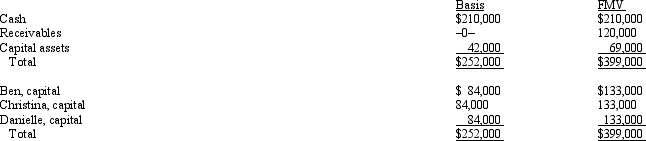

The December 31, 2011, balance sheet of the BCD General Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2011, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2011, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: Which of the following transactions will not

Q88: In a proportionate liquidating distribution in which

Q89: On August 31 of the current tax

Q90: The JIH Partnership distributed the following assets

Q92: Which of the following is not true

Q93: Chelsea owns a 25% capital and profits

Q95: On December 31 of last year,Rachel gave

Q96: Your client has operated a sole proprietorship

Q128: Which of the following statements, if any,

Q224: Susan is a one-fourth limited partner in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents