On January 1, 2014, Paul Corporation acquired a 90% interest in Satorius Company for $360,000 when Satorius' stockholders' equity was $400,000; with Common stock of $200,000 and Retained earnings of $200,000.

On January 1, 2014, Satorius Company purchased a 10% interest in Paul Company for $90,000 when Paul's total stockholders' equity was $900,000; with Common stock of $500,000 and Retained earnings of $400,000.

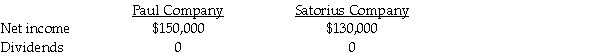

The following data was available for the year ending December 31, 2014:

Use the conventional approach to account for the mutually-held stock. Assume there were no book value/fair value differentials for each investment. The separate net incomes do not include investment income.

Use the conventional approach to account for the mutually-held stock. Assume there were no book value/fair value differentials for each investment. The separate net incomes do not include investment income.

Required:

1. Prepare the journal entry for Paul on January 1, 2014.

2. Prepare the journal entry for Satorius on January 1, 2014.

3. Prepare the journal entry to record the constructive retirement of 10% of Paul's outstanding stock due to Satorius' purchase of Paul's stock.

4. Determine the incomes of Paul and Satorius on a consolidated basis with mutual income for 2014 using simultaneous equations.

5. What is controlling interest share of consolidated net income and noncontrolling interest shares for 2014?

6. What is consolidated net income?

Correct Answer:

Verified

P = the in...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Use the following information to answer the

Q3: Use the following information to answer the

Q11: Raymond Company owns 90% of Rachel Company.Rachel

Q12: Use the following information to answer the

Q19: Use the following information to answer the

Q23: Paik Corporation owns 80% of Acdol Corporation

Q23: On January 1, 2014, Singh Company acquired

Q24: On January 1, 2014, Peabody Corporation acquired

Q24: Packer Corporation owns 100% of Abel Corporation,Abel

Q26: On January 1, 2014, Wrobel Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents