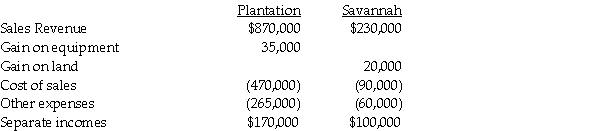

Separate income statements of Plantation Corporation and its 90%-owned subsidiary, Savannah Corporation, for 2014 are as follows, prior to Plantation recording any income related to its subsidiary:

Additional information:

Additional information:

1. Plantation acquired its 90% interest in Savannah Corporation when the book values were equal to the fair values.

2. The gain on equipment relates to equipment with a book value of $95,000 and a 7-year remaining useful life that Plantation sold to Savannah for $130,000 on January 1, 2014. The straight-line depreciation method was used and the equipment has no salvage value.

3. On January 1, 2014, Savannah sold land to an outside entity for $90,000. The land was acquired from Plantation in 2009 for $70,000. The original cost of the land to Plantation was $45,000.

4. Savannah did not declare or distribute dividends in 2014.

Required:

1. Prepare elimination/adjusting entries on the consolidated worksheet for the year 2014.

2. Prepare the consolidated income statement for the year ended December 31, 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Pollek Corporation paid $16,200 for a 90%

Q22: On January 1, 2013, Pilgrim Imaging purchased

Q23: Plower Corporation acquired all of the outstanding

Q24: Palmer Corporation purchased 75% of Stone Industries'

Q25: Pigeon Company owns 80% of the outstanding

Q26: Porter Corporation acquired 70% of the outstanding

Q28: On January 2,2014,Pal Corporation sold warehouse equipment

Q30: Passo Corporation acquired a 70% interest in

Q31: Separate income statements of Pingair Corporation and

Q39: Several years ago,Pilot International purchased 70% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents