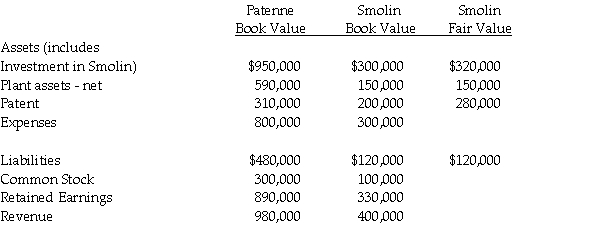

On December 31, 2014, Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000. The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years, and a patent which was undervalued by $40,000 and had a remaining life of 5 years. At December 31, 2016, the companies showed the following balances on their respective adjusted trial balances:

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31, 2016.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31, 2016.

Requirement 2: Calculate consolidated net income for 2016, and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31, 2016.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: On January 1, 2014, Paisley Incorporated paid

Q29: Pull Incorporated and Shove Company reported summarized

Q30: Platt Corporation paid $87,500 for a 70%

Q31: On January 1, 2014, Persona Company acquired

Q32: Parakeet Company has the following information collected

Q34: Puddle Corporation acquired all the voting stock

Q35: On December 31, 2014, Paladium International purchased

Q37: Packo Company acquired all the voting stock

Q38: On January 2,2014,PBL Enterprises purchased 90% of

Q38: Powell Corporation acquired 90% of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents