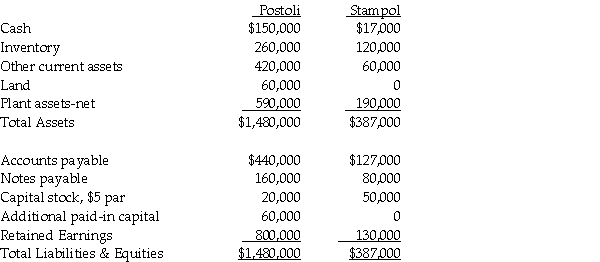

On June 30, 2013, Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated. Postoli paid $40,000 in cash to the owner of Stampol, and signed a five-year note payable to the owners of Stampol in the amount of $200,000. Their closing balance sheets as of June 30, 2013 are shown below. In the purchase agreement, both parties noted that Inventory was undervalued on the books by $10,000, and Pistoli would also take possession of a customer list with a fair value of $18,000. Pistoli paid all legal costs of the acquisition, which amounted to $7,000.

Required:

Required:

1. Prepare the journal entry Postoli would record at the date of acquisition.

2. Prepare the journal entry Stampol would record at the date of acquisition.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Pali Corporation exchanges 200,000 shares of newly

Q22: On December 31, 2013, Peris Company acquired

Q23: At December 31, 2013, Pandora Incorporated issued

Q24: Samantha's Sporting Goods had net assets consisting

Q25: The balance sheets of Palisade Company and

Q27: Pony acquired Spur Corporation's assets and liabilities

Q28: Saveed Corporation purchased the net assets of

Q29: Parrot Incorporated purchased the assets and liabilities

Q30: On January 2, 2013, Pilates Inc. paid

Q31: On January 2, 2013 Palta Company issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents