Use the following information to answer the question(s) below.

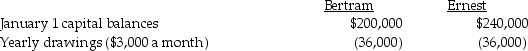

Bertram and Ernest share profits and losses equally after salary and interest allowances. Bertram and Ernest receive salary allowances of $40,000 and $60,000, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month, regardless of when additional capital contributions or permanent withdrawals are made subsequently within the month. Partners' drawings of $3,000 per month are not used in determining the average capital balances. Total net income for 2014 is $240,000. Permanent withdrawals of capital:

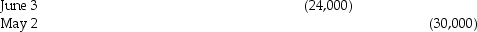

Permanent withdrawals of capital:

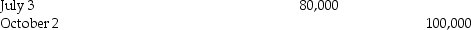

Additional investments of capital:

Additional investments of capital:

-If the average capital for Bertram and Ernest from the above information is $224,000 and $238,000,respectively,what will be the total amount of profit allocated to salary and interest distributions?

A) $93,800

B) $146,200

C) $218,200

D) $240,000

Correct Answer:

Verified

Q3: Under the Uniform Partnership Act,loans made by

Q4: Austin contributes his computer equipment to the

Q5: If the partnership agreement provides a formula

Q6: In the Uniform Partnership Act,partners have

A)mutual agency.

B)limited

Q7: Use the following information to answer the

Q9: The XYZ partnership provides a 10% bonus

Q10: Partnerships

A)are required to prepare annual reports.

B)are required

Q11: A partner assigned his partnership interest to

Q12: Use the following information to answer the

Q13: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents