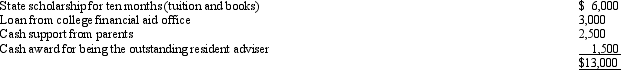

Ron, age 19, is a full-time graduate student at City University.During 2012, he received the following payments:  Ron served as a resident advisor in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied. What is Ron's adjusted gross income for 2012?

Ron served as a resident advisor in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied. What is Ron's adjusted gross income for 2012?

A) $1,500.

B) $4,000.

C) $7,500.

D) $15,500.

E) None of the above.

Correct Answer:

Verified

Q42: Jack received a court award in a

Q43: Olaf was injured in an automobile accident

Q46: The exclusion for health insurance premiums paid

Q48: The taxpayer is a Ph.D.student in accounting

Q52: Turquoise Company purchased a life insurance policy

Q54: Barney is a full-time graduate student at

Q55: Christie sued her former employer for a

Q58: Early in the year, Marion was in

Q59: In 2012, Khalid was in an automobile

Q67: The Perfection Tax Service gives employees $12.50

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents